Payments explained: What are recurring payments?

What is a recurring payment?

A one-time payment lets customers pay for their order immediately; recurring payments establish a periodic or repeated payment in the form of a subscription in exchange for the delivery of your products or services.

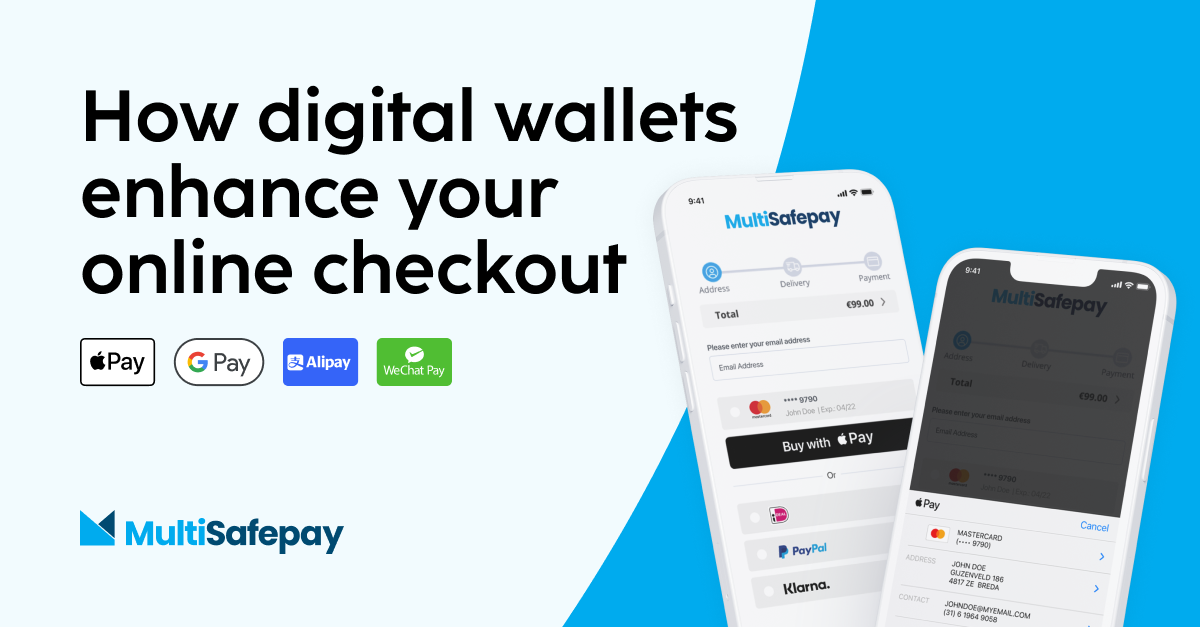

A recurring payment is carried out through any available payment method you already have in your business or want to incorporate: credit or debit cards, direct debit, or digital wallets.

There are many different payment terms available. Depending on your product or service and the profile of your customers, you can collect payments monthly, quarterly, biweekly, or completely on your own terms.

How do recurring payments work?

One-time payments are relatively simple. Recurring payments often take the concept of a one-time payment and, through technologies such as tokenization (more on this below), turn this concept into a safe way of repeatedly using data.

We’ll take you through a step-by-step explanation of how recurring payment technology works.

#1 Your customer makes an initial payment and enters the payment and personal data. After the payment is processed, a one-time purchased is finalized. The data entered here is then processed for potential recurring payments.

#2 The sensitive data is encrypted and saved as a token to safely handle customer data. This token corresponds with the payment data in a so-called vault, which makes the token useless without the vault. The encrypted token is then stored in your webshop and linked to the user.

#3 The payment and billing process is now automated in a highly secure fashion. The token is used for follow-up purchases, for both merchant- and customer-initiated transactions.

Recurring payment types

As we touched on briefly in the last step of our explanation, there are two main categories into which we can divide recurring payments:

#1 Merchant-initiated transactions

A subscription is the most common and straightforward example of this type of transaction. The customer enters their payment details and gives approval, after which the merchant (you) initiates the transaction on a regular basis. The merchant is the one who takes action to arrange payment.

Good examples of this are Netflix subscriptions, delayed charges such as a hotel minibar charging the customer after the delivery of services, or automatic installment payments through Buy Now, Pay Later.

#2 Customer-initiated transactions

The other alternative is transactions where the customer initiates the action. Here the merchant stores the payment data safely and uses it when the customer makes the request. After tokenizing the payment and storing the associated data safely, the following transactions are one-click purchases.

A good example is services such as Uber or purchases through Amazon.

Additional note: SEPA recurring payments

If you’re processing recurring payments through direct debit, it’s essential to have a SEPA mandate. Without this mandate, you don’t have legal access to charge customers' accounts repeatedly.

If you don’t have a SEPA mandate, your customer will be able to return bills paid within 58 days, which opens your business up to potential risks.

Therefore, if you’re planning to use direct debit for your recurring payments, we highly recommend getting this sorted.

The impact of recurring payments on your business

Incorporating a recurring payment system into your online store can generate a series of benefits that can directly influence the satisfaction of your customers and make your business more profitable.

Let’s have a look at what that means for you.

#1 Simplify the shopping experience for your customers

After permitting you to use their payment details, the payment process is incredibly straightforward for your customers.

The purchasing process becomes almost automated, delivering a frictionless checkout process for the customer. By creating that smooth shopping experience, you’ll notice more returning customers.

#2 Increase and regularize your income

Recurring payments help you create a predictable stream of income. If your business lends itself to a recurring business model, it can help you plan your expenses easier.

Perhaps more important, creating a refined recurring payment process helps build loyalty among your customers. After all, keeping customers is cheaper than finding new ones, so you should try to maximize your efforts to keep your existing customers coming back.

#3 Get key information about your business

Data is vital, especially when looking to improve your product or services and finetune it to your customers.

Establishing a longer relationship with your customers helps you gather more important data. Metrics such as customer lifetime value, abandonment rate, or engagement become significantly easier to measure and more valuable with recurring payments.

Ready to streamline your recurring payment procedures? Let’s talk

Our vision is a payment world without barriers and frictions, so we focus on helping our merchants within different verticals establish a payment strategy that suits them best.

If you’re looking to take that next step in your online approach, don’t hesitate to reach out.